Instant-Approval Installment with No Credit Check — 1F Cash Advance Introduces Streamlined Approval for Bad Credit

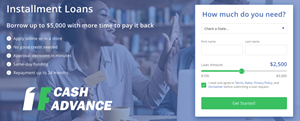

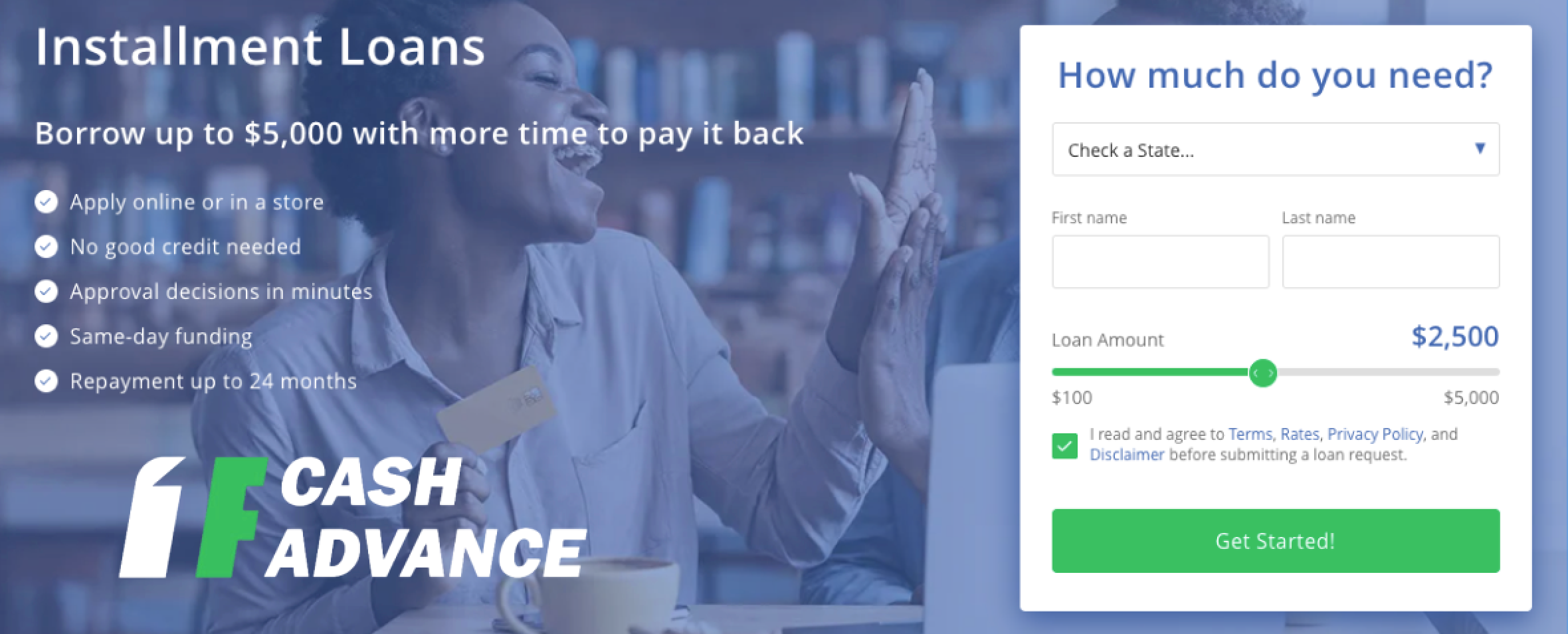

Introducing the 1F Cash Advance fast and easy Installment Loans for Bad Credit Borrowers - Near Me Nationwide Coverage, Same-Day Deposit, Flexible Repayment Plans, Up to $5,000.

HOUSTON, Oct. 10, 2025 (GLOBE NEWSWIRE) -- Installment loans are now offered online through 1F Cash Advance as a new way for borrowers to access flexible funding with clear, predictable repayment terms. Unlike payday or title loans, these monthly loans with guaranteed approval are structured, making them easier to manage for people dealing with bad credit or no credit history.

Apply through 1F Cash Advance and choose Installments that fit your schedule!

With this update, the company now provides options designed for borrowers who have been turned away by traditional banks. These bad credit installment loans are built for high-risk or poor credit applicants who need fast funding without the burden of a hard credit check.

The main advantage is that 1F Cash Advance helps clients find a safer and more transparent path to urgent financing. By partnering only with trusted lenders, the platform ensures borrowers can apply online, receive an instant decision, and, in many cases, get same day approval.

Why Installment Loans Are a Better Fit for Bad Credit Borrowers

Bad credit borrowers often face barriers when dealing with conventional financial institutions. Many banks and credit unions require strong FICO scores, extensive documentation, or a cosigner. That’s not always practical — especially during emergencies or when fast funding is required.

This is where bad credit installment loans with guaranteed approval come into play. These loans are designed for individuals who need fast decisions and flexible terms without being penalized for past financial mistakes. In most cases, the application process is fully online and does not require a visit to a physical location. The ability to borrow amounts ranging from $100 to $5,000 and repay over 2 to 24 months gives applicants more time and control over their repayment schedule.

Unlike payday loans, which are short-term and often require full repayment in two weeks, installment loans without credit checks distribute payments across months. This allows borrowers to stay current on bills, avoid rollovers, and reduce the risk of falling into a debt cycle.

Guaranteed Approval: How It Works and What to Expect

In the online lending space, the term installment loans with guaranteed approval usually refers to products with a high acceptance rate — even for those with really bad credit. While no lender can offer absolute guarantees, many services prioritize income and ability to repay over credit history.

For example, an applicant with a steady income from a job, freelance work, or benefits may still be approved despite a poor credit score. Direct lenders evaluate a borrower’s real-time financial situation rather than past records. This process often includes a soft credit check, which does not impact the credit score.

Typically, applicants receive a loan decision within minutes after submitting the online form. If approved, they are presented with loan clear loan terms from trusted lenders partnered with 1F Cash Advance, which must be reviewed and accepted before funds are transferred. Many lenders offer same day approval, with disbursement occurring on the same business day if confirmation happens early enough.

No Credit Check Installment Loans: Direct Lender Benefits

One major reason many borrowers choose installment loans with no credit check is simplicity. When working with direct lenders, there’s no intermediary or third-party platform collecting and reselling user data. This means a shorter processing chain, more privacy, and usually faster funding.

Here are the key benefits of choosing direct lenders:

- No brokers involved, which eliminates additional fees

- Faster decision-making processes

- Direct communication regarding loan terms and repayments

- Better data protection through encrypted channels

- Higher transparency, since terms are disclosed upfront

Instead of relying solely on credit reports, lenders may approve applicants based on their ability to repay, current banking activity, and employment status. This model works particularly well for those with irregular income sources such as gig work, disability support, or part-time jobs.

Main Advantages of Getting Installment Loans via 1F Cash Advance

Choosing installment loans through 1F Cash Advance offers a range of borrower-friendly features. As a trusted platform with six years of experience and presence in over 37 states, 1F Cash Advance focuses on delivering flexible loan options to individuals with limited access to traditional credit channels.

Applicants can expect the following:

- Fast decision-making with no hard credit check

- Loan amounts ranging from $100 to $5,000

- Repayment terms from 2 to 24 months

- No collateral or guarantor requirements

- Clear interest rates and no hidden fees

- Same-day funding for applications approved before 10:30 a.m.

Whether the borrower is dealing with car repairs, medical expenses, rent shortages, or utility bills, the platform offers structured loans with predictable monthly payments. Even applicants with no credit history are considered based on their current financial profile.

In addition, 1F Cash Advance partners exclusively with direct lenders, which reduces processing delays and avoids third-party data sharing. It’s a safer and faster way to apply for loans online – without unnecessary paperwork or in-person visits.

Get the installment funding today! 1F Cash Advance puts flexibility and control in your hands.

Step-by-Step: How to Apply for Installment Loans at 1F Cash Advance

The loan application process at 1F Cash Advance is fully digital and designed for ease of use. The platform streamlines the experience so that even first-time applicants can complete the process in just a few minutes. Here’s how it works:

- Visit the website and go to the online installment loan application page.

- Enter basic details, including your full name, address, employment or income information, and bank account number.

- Submit the form and wait for a decision. Most users receive a response within minutes.

- Review the loan terms provided by the direct lender. This includes the total loan amount, repayment period, and applicable APR.

- Accept and sign the loan agreement electronically.

- Receive the funds as soon as the same business day if confirmation occurs before the cut-off time.

Borrowers are encouraged to review the terms carefully before proceeding. If approved, funds are sent directly to the applicant’s checking account. Since the process relies on an online application only, there’s no need to upload supporting documents or make phone calls — the entire experience is streamlined by loan companies partnered with the brand and focused on eliminating unnecessary steps.

Who Qualifies and How Application Process Works?

1F Cash Advance serves those often denied by conventional banks. Although the platform does not promise 100% approval, it provides a significantly higher acceptance rate than traditional lenders — especially for high-risk borrowers.

Basic eligibility criteria include:

- Being at least 18 years old

- Legal residency or U.S. citizenship

- A valid checking account in the applicant’s name

- A verifiable source of income (employment, gig work, government benefits, etc.)

There is no requirement for a high credit score, a cosigner, or collateral. Even those labeled as high-risk borrowers can access funding when they demonstrate an ability to manage monthly payments. Most services offered through the platform perform only soft inquiries, which don’t impact credit scores.

Borrowers who rely on non-traditional income sources — such as disability payments, part-time jobs, or self-employment — are also considered. Thanks to this approach, high-risk borrowers can qualify for some of the best guaranteed approval installment loans available online, provided by legit loan companies focused on fair and transparent terms.

Why 1F Cash Advance Is a Trusted Option?

With over 3 million loans issued and locations across 37 states, 1F Cash Advance has become a trusted option for applicants with poor credit, no credit, or limited income documentation — groups that are usually ignored by traditional lenders.

Borrowers benefit from:

- No third-party involvement — the platform connects users directly to licensed lenders

- Fast and secure funding — loans may be funded on the same day for early approvals

- Reasonable terms — repayment periods from 2 to 24 months with predictable monthly payments

- No hard inquiries — loan decisions based on current income, not past credit history

- Clear pricing — interest rates and fees are provided before any agreements are signed

Those who meet the basic eligibility criteria can explore flexible no credit check loans without unnecessary delays or documentation.

Frequently Asked Questions (FAQ)

What are installment loans and how do they work?

Type of loans that are structured as fixed-term products with equal monthly payments. Borrowers receive a lump sum through a simple online application and repay it over 2 to 24 months, depending on the repayment terms. This makes them easier to manage than short-term emergency loans.

Can I get approved with bad or no credit?

Yes. 1F Cash Advance specializes in connecting bad credit borrowers based primarily on income and repayment ability, not past credit history. Even applicants with poor or no credit can qualify for installment loans if they demonstrate stable deposits.

Is there a credit check involved?

Only a soft check, which won’t affect your credit score. When a lender performs a soft check, it simply reviews a limited version of your credit report to confirm your name, address, and general financial history. This helps them estimate whether you meet their initial criteria

How fast can I receive the funds?

If your application is approved by a direct lender before 10:30 a.m. on a business day, funds may be deposited on the same day. Thanks to partnerships with top lenders, 1F Cash Advance provides some of the easiest online installment loans with fast funding. Otherwise, you can expect to receive emergency cash by the next business day.

Are there hidden fees?

No. 1F Cash Advance works with legit and direct lenders only, so they disclose all charges upfront, including interest and origination fees. Borrowers will see clear repayment terms before signing, and prepayment is usually allowed without penalties.

About 1F Cash Advance

1F Cash Advance is a trusted online platform helping individuals find fast and flexible funding solutions, even with limited or poor credit histories. With a commitment to transparency, speed, and fair lending practices, the company connects borrowers with licensed direct lenders offering personal loans, payday loans, and cash advances tailored to real-world financial needs. Through a simplified online process, 1F Cash Advance empowers families and individuals to handle unexpected expenses with confidence and clarity.

Media Contact Info

Mailing Address

1F Cash Advance, LLC

1942 Broadway St., STE 314C Boulder, CO 80302

Main Office Location

2770 Canyon Blvd, Boulder, CO 80302

Website: https://1firstcashadvance.org

E-mail: info@1firstcashadvance.org

Phone: (720) 428-2247

Social Media:

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/a9fbffb0-8c73-4753-8ed9-8f9083c8258a

https://www.globenewswire.com/NewsRoom/AttachmentNg/371367ad-ed8f-40f4-986f-be594ba8ec43

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.